Video: How Currency Pairs and Bid/Ask Spread Works in Forex

Investing in assets such as stocks, bonds, cryptocurrencies, futures, options, and CFDs involves considerable risks. CFDs are especially risky with 74-89% of retail accounts losing money due to high leverage and complexity. Cryptocurrencies and options exhibit extreme volatility, while futures can also lead to significant losses. Even stocks and bonds can depreciate quickly during market downturns, and total loss can ensure if the issuing company fails. Furthermore, the stability of your broker matters; in case of bankruptcy, the presence of an effective investor compensation scheme is crucial for protecting your assets. It's vital to align these investments with your financial goals and if needed, consult with financial professionals to navigate complex financial markets.

Read more about us ⇾We earn commissions from some affiliate partners at no extra cost to users (partners are listed on our ‘About Us’ page in the ‘Partners’ section). Despite these affiliations, our content remains unbiased and independent. We generate revenue through banner advertising and affiliate partnerships, which do not influence our impartial reviews or content integrity. Our editorial and marketing teams operate independently, ensuring the accuracy and objectivity of our financial insights.

Read more about us ⇾Data is continually updated by our staff and systems.

Last updated: 24/07/2020

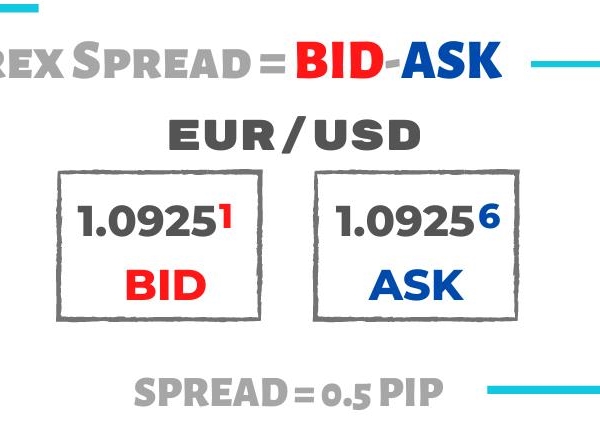

The foreign exchange market (Forex) is always traded in pairs. Whenever you see a currency exchange rate, it will belong to a currency pair such as USD/CAD. USD/CAD indicates two currencies: the US Dollar and the Canadian Dollar.

Part of our multimedia library, learn in this video how currency pairs and bid/ask spread works in Forex to enrich your trading knowledge.

You might also like to read: